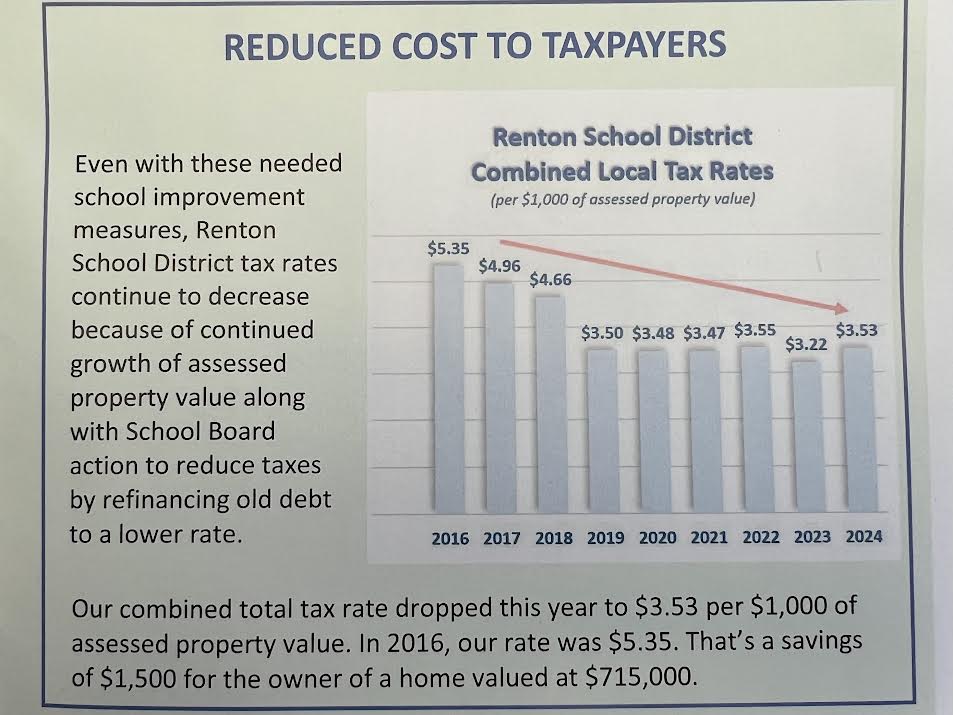

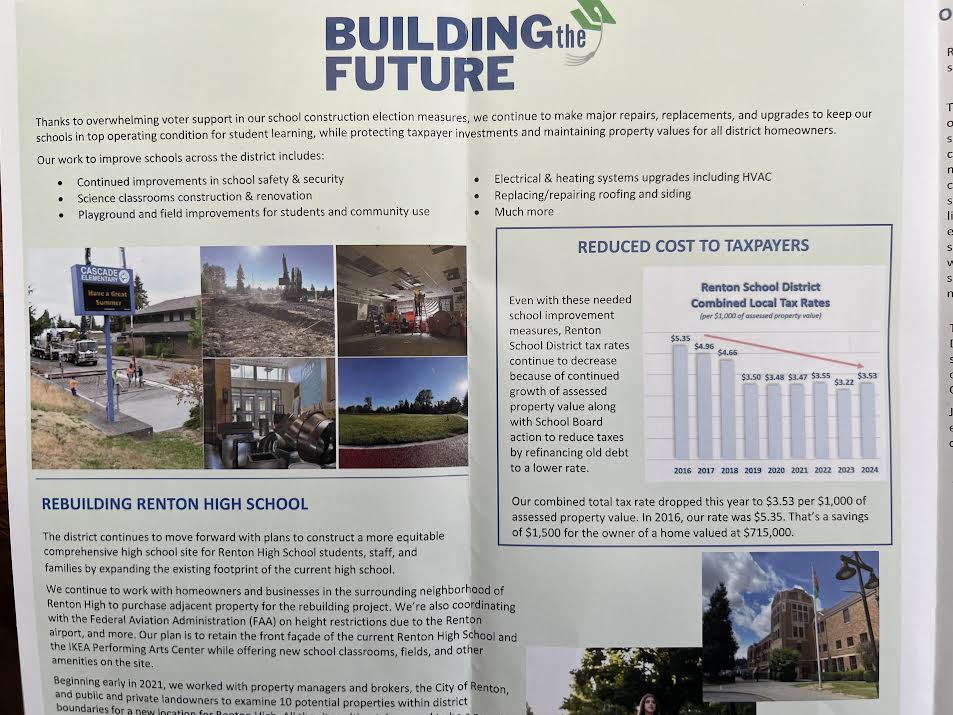

Renton School District sends out regular mailers telling us they are reducing our costs. They base their analysis on a non-existent (magic?) house that did not increase in value from 2016 to 2024. Can we really trust them to educate our children when they present data in such a misleading way?

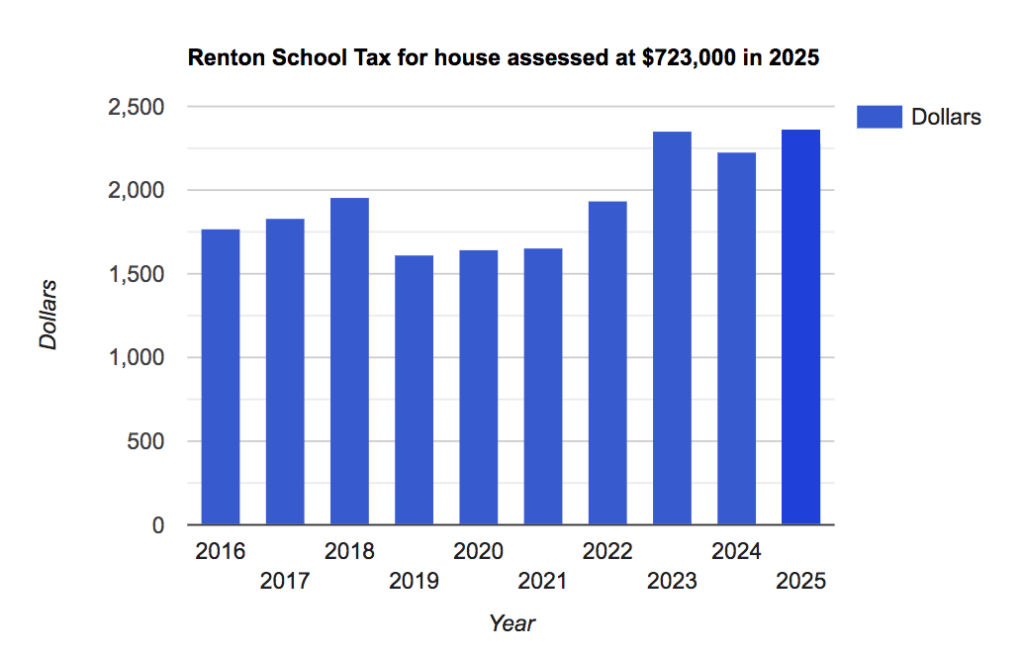

In reality, the taxes for the school district are rising quickly. This is a typical Renton Highlands house (owned by my son) valued at $723,000 in 2025. This house appreciated at a normal rate with all the others, with no remodeling. The local school taxes went up significantly, not down $1500.

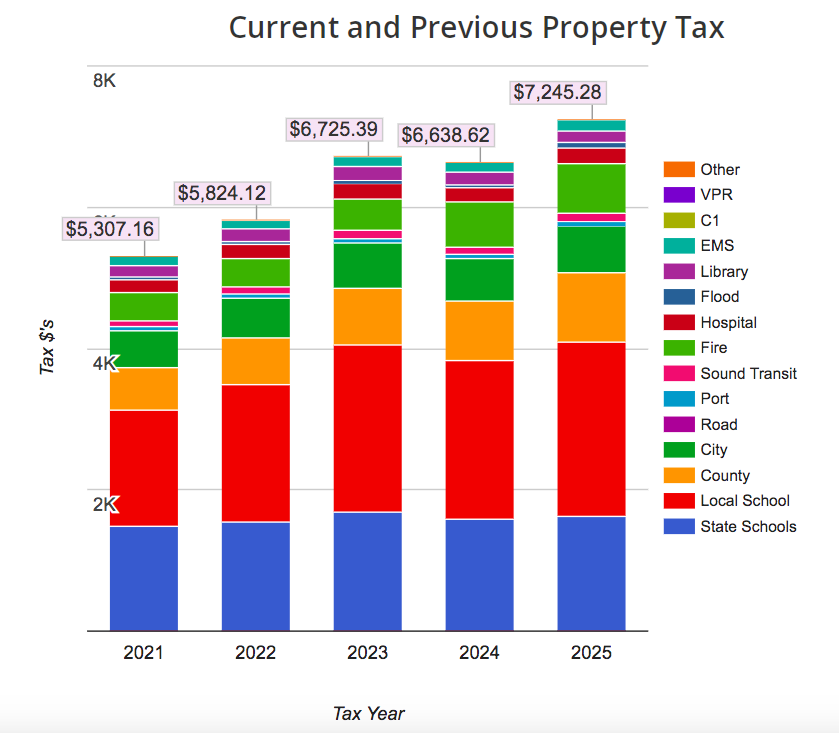

With Renton School District spending millions of dollars in controversial ways, it’s important for everyone to understand how much tax we really pay into the Renton School District.

Contrary to the District’s published statements that typical taxes have gone down $1500 over ten years, Renton’s local school taxes have actually been going up fast, rising by many hundreds of dollars per year for a typical home during this time.

I voted for the last two bond measures, along with my extended family. But after hearing about all the homes and businesses being taken, I’m regretting it. It’s even more disappointing to work out what the real costs are, compared to what the district claimed in their literature and the voter pamphlet.

Future bond issues need to be sold to the public based on proving they are judicious use of resources to fund needed upgrades, not based on misleading numbers for a pretend house.

In addition, future voter pamphlets need to be honest about the intended work. And the school board needs to plan ahead so we’re not tearing out millions of dollars of upgrades that we just completed in the previous bond issue. And we certainly should not be taking homes and businesses to build the nation’s most expensive high school baseball stadium when we have many other good alternatives. And if it’s about equity among the high schools, why isn’t Renton High finally getting a swimming pool when the other high schools have them?

This 2021-2025 chart for my son’s typical Renton home comes directly from King County’s Tax Transparency Tool. The red bar is the local schools tax, and the blue is our state school tax. 56% of our property taxes goes to schools. Total school tax has increased from $3,134 to $4,092. Local school taxes have increased from $1,658 to $2,469, up $811, a 32% increase (about twice the rate of inflation).

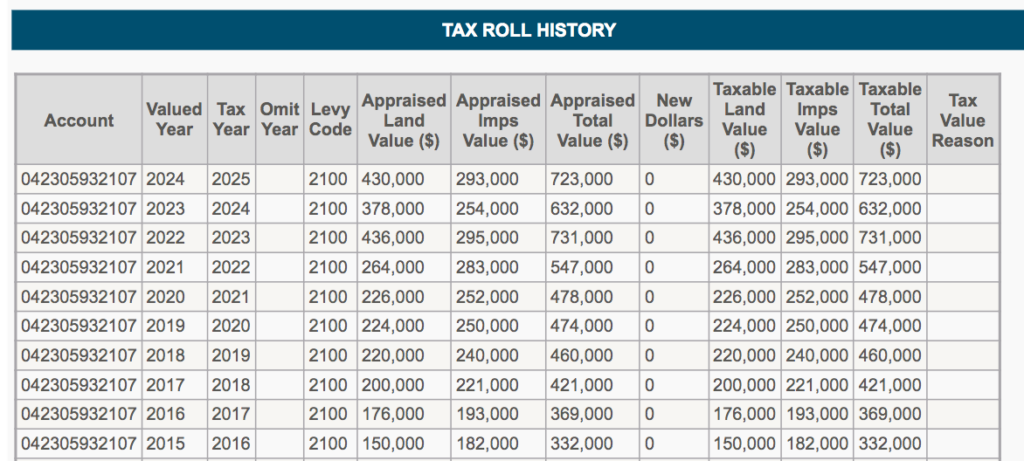

The tax history of the typical $723,000 house in 2025. This house in Renton Highlands, owned by my son, has had normal maintenance but no significant improvements during the ten years. If you multiply the taxable total value in the last column by the dollars-per-thousand in the school district pamphlet, you’ll get the numbers I showed in my chart above.

Public entities are allowed to present factual information to citizens, but the trend line isn’t factual. If someone has time on their hands, they should tell the PDC who handles such cases of electioneering.

The red portions if the graph have gotten bigger! I was at meetings when that man for the school district said they would not increase and actually said they would decrease! How can they get away with that?