Yesterday the Renton Mayor released an Airport statement explaining that council felt compelled to evict The Landing Gear Works (TLGW). He put sole blame on TLGW for falling behind in rent without mentioning the serious billing errors by his administration that plunged TLGW into rent arrears. I’m describing these errors here for the first time. (The Mayor also didn’t mention the failure of the airport manager to extend a long enough lease to make building repairs, per airport lease policy, and I’ve covered that here.)

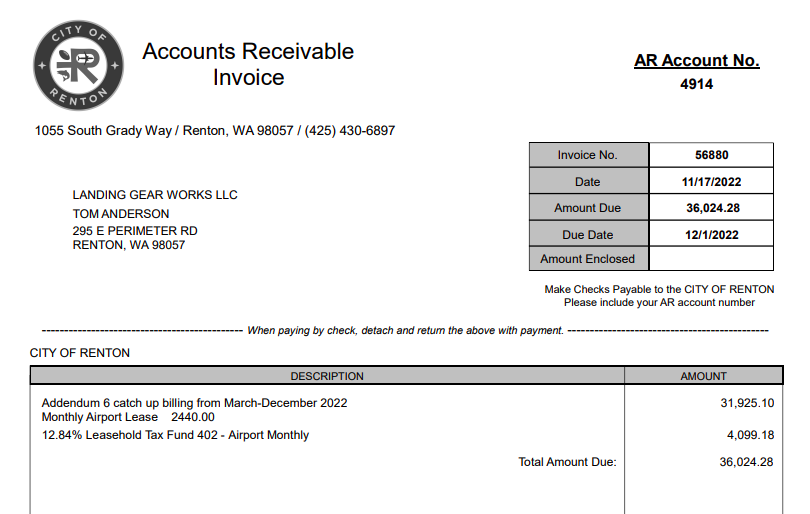

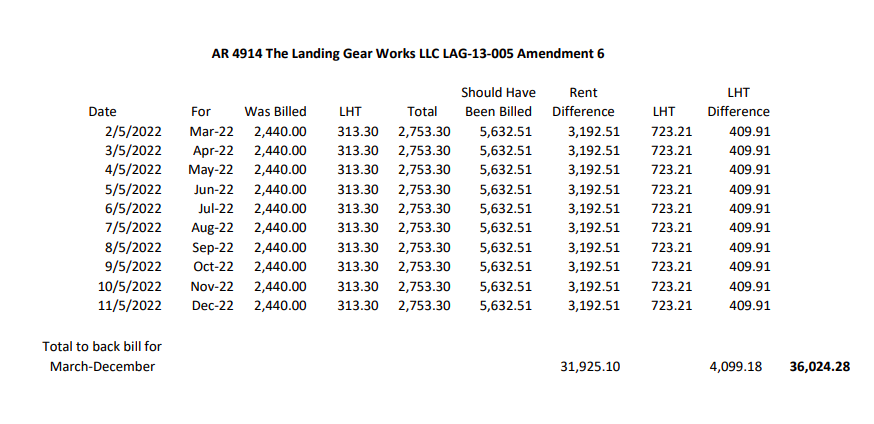

In November 2022 the Renton Airport Business Manager realized he had a serious problem. He had been underbilling The Landing Gear Works (TLGW) for months for their hangars, workshops and offices on Renton airport. The lease rate had increased and the new amount was NOT reflected in the bills. The accounting error added up to five months of lease payments. The Airport’s error would be bad news for TLGW and would negatively impact their business, especially on the heels of the pandemic. It would have been courteous to call or visit TLGW to break the news, apologize for the mistake, and work out a plan. But instead, the Airport Manager just directed his accountant to send a bill for the corrected amounts.

His efforts to downplay the error resulted in predictable confusion in the offices of Landing Gear Works and Renton City Accounting.

When the bill for the error showed up in the accountant’s office at Landing Gear Works, she wrote back to the City “Is there a way to fix this statement to reflect the actual balance of $14709.22? In the meantime I will get another payment asap.” When she received a response from the city, she immediately forwarded it to President Tom Anderson with this email message: “I asked for a current statement from the City of Renton for the rent. This is what she sent.”

Tom Anderson’s shock is apparent in his email reply: ” This says we owe 50K !!!!!!!!! ”

The Airport Manager and his boss, the Public Works Administrator, obviously knew it looked bad. Whenever they told this story, they referred to it, unfairly, as the Landing Gear Works falling behind on rent, never mentioning the city’s own accounting mistakes that contributed to it. To this day I have not seen them publicly explain it to City Council or the Renton Community.

As Mr. Anderson was working to catch up from the city’s billing error, his roof began to leak. That is where I picked up the story in my first post on The Landing Gear Works.

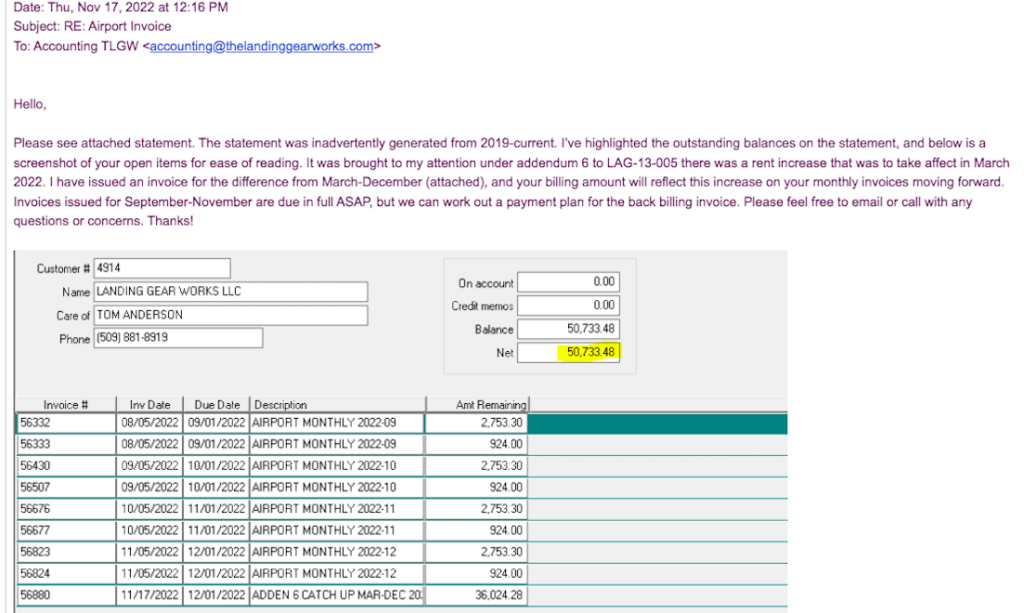

Here is the statement from the city that started it all. The text in the first image reads as follows:

———- Forwarded message ———

From: <City of Renton Accounting>

Date: Thu, Nov 17, 2022 at 12:16 PM

Subject: RE: Airport Invoice

To: Accounting TLGW <accounting@thelandinggearworks.com>

Hello,

Please see attached statement. The statement was inadvertently generated from 2019-current. I’ve highlighted the outstanding balances on the statement, and below is a screenshot of your open items for ease of reading. It was brought to my attention under addendum 6 to LAG-13-005 there was a rent increase that was to take affect in March 2022. I have issued an invoice for the difference from March-December (attached), and your billing amount will reflect this increase on your monthly invoices moving forward. Invoices issued for September-November are due in full ASAP, but we can work out a payment plan for the back billing invoice. Please feel free to email or call with any questions or concerns. Thanks!

Mr. Anderson met with the Airport staff and they agreed on a plan. TLGW would pay the previously unbilled amounts over time. But the airport’s normal bills do not contain a lot of information, and the catch-up accounting proved confusing and time-consuming. The City made more errors along the way. Accountants at Landing Gear Works and the City struggled to coordinate how to apply payments to current rent vs back rent. The Airport Leadership, not TLGW, had created the billing confusion and abundance of overdue rent.

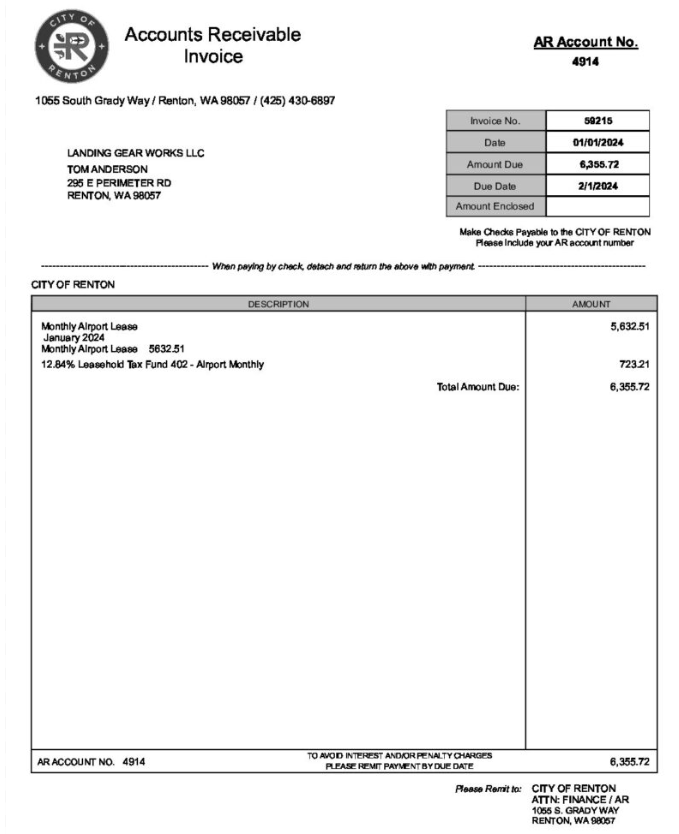

Typical bill received by Landing Gear Works. The Company paid these bills throughout 2022, only to be told they had fallen behind. This bill from February 2024 does not give any clue as to past due amounts.

The remainder of this article is a tiny sample of the actual back and forth emails between their offices. I’ve removed the names and email addresses of personnel.

—————————————————————————————–

———- Forwarded message ———

From: <City of Renton Accounting>

Date: Fri, Jun 2, 2023 at 4:31 PM

Subject: RE: Enclosed

To: Accounting TLGW <accounting@thelandinggearworks.com>, Thomas Anderson <tom@tlgw.aero>

Hi,

Thank you for calling earlier. I reread the letter you were sent last week, and realized I was incorrect as to how I should apply the payments when they are received. Starting with the payment you’ve mailed this week; we will apply to your current month’s invoices (June in this case) and the additional payment will be applied towards the oldest invoice first. That means the $33,294 back bill will receive the additional payments first, and we will then work our way to March, April, and May. The past due amount owed is $55,133.16. I’ve calculated the past due amount will be paid off and you will be current in 8 months. Please feel free to reach out if you have any questions. I will relay this information to the airport staff. Thanks again!

Thank you, Accounting Assistant, City of Renton

———- Forwarded message ———

From: Accounting TLGW <accounting@thelandinggearworks.com>

Date: Wed, Sep 27, 2023 at 3:45 PM

Subject: Re: September and October rent

To: <City of Renton Accounting>

Cc: Joey Root <JRoot@rentonwa.gov>

Hello,

Thank you for the reply. I appreciate it, however, I have a question on the back bill payment for August. In our records, we show check #s 22857 and 22856 paying July and June respectively. The August payment I dropped off was for August. I am confused as to where the back bill would be? I am thinking the back bill would be for September next week?

I am so very sorry for my confusion. Was there something I missed on this? I would appreciate any information.

Thank you very much.

Sincerely,

Bookkeeper/Office Manager

The Landing Gear Works

On Wed, Sep 27, 2023 at 3:23 PM <City of Renton Accounting> wrote:

Hi,

The airport and finance are ok with receiving September’s rent and back-bill payment by next Friday, 10/6. I also noticed when reviewing the account today that the payment received last week was just for August’s rent. We have not received the back-bill payment for August yet, which is an additional $7,279.72. This means by 10/6 to remain in good standing with the payment arrangement, Landing Gear Works will need to remit $7,279.72 for the August back bill payment and $14,559.44 for the September rent payment and September back-bill payment ($21,839.16 total).

Thank you, <Accounting Assistant, City of Renton>

So, a business tenant gets underbilled for a lease they agreed to in writing and has to pay it back over time without interest?

I fail to see the tragedy.

(If you’re ever in a situation like this yourself and are making up for missed payments and need to keep current, always send two checks: one for the current payment and another for the back payment. This will make life much simpler for everybody. )

What would everyone think of this landlord?

Landlord: Tell your accountant to pay the bill I send her every month, or you are being evicted

Tenant: Roger, got that

Landlord: I raised your rent nine months ago, and forgot to include the new amount in the bills I sent to your accountant. You owe me $36,000 right now. And I’m telling everyone you are a deadbeat.

Tenant: What the…..!

If the tenant wasn’t informed of the rate increase, the landlord can go pound sand. But I’m not seeing that.

Is that the case? The tenant wasn’t informed?

They were sending TLGW multiple bills because they had various properties on the airport. In some cases the city combined the bills, and in others they didn’t.

It was not obvious to me looking at the bills that they didn’t match the leases, unless one gathered all the bills each month and all the leases each month, and compared them. The bills do not make it easy for the payer what the bill is for.

Tom Anderson was focussed on designing and manufacturing Landing Gear, and understandably relied on airport staff to send the proper bills. He did his job, they goofed up theirs. I think he was also dealing with flooding from roof failures around this time.

But he should have known about the rate increase… if the city sent a letter during the new rate change “hey dude, rent is doubled” the they can’t say this was unexpected.

If the city didn’t send that notification, then he really has a point and should be excused on the increase for those months.

But, as a business owner, he should know exactly what his anticipated expenses should be, and saying the bill was wrong doesn’t quite cut it if the notice has been sent.

To clarify, I believe even if the tenant has been incorrectly billed, they would owe the back rent. However the misbilling can create a hardship that is not the fault of the tenant, and deserves a thoughtful and compassionate time-period to correct. In addition, it’s not fair to create public records blaming soley the tenant for falling behind during a period the city was misbilling. Also, once the misbilling occured, new bills could have been more specific and clear, to better keep track of the ongoing balance owed.

I’ve been a property manager for over 30 years and never had the problem of misbilling a tenant. This is because I make it clear in the lease that the lease is also the bill. In the lease I specify exactly what the monthly rent is, when it is due each month, and where it should be delivered/sent/or e-transfered at the tenant’s option. If a tenant falls behind, I send a polite written communication reminding the tenant of the specific (and correct) amount owed, including a breakdown of past due charges. This system has never failed me.

If the city feels compelled to send a bill, they should double-check that it aligns with the lease. If they do ever discover an error months down the road, which should be extremely rare, then they should not refer to the error as “the tenant falling behind”, but instead as a period when the city was mis-billing that has necessitated a coordinated remedy.

Yes, it’s possible that the tenant or their accountant could have found the error, but this should not be considered a certainty. The person preparing the bill should take primary responsibility for its accuracy, and then own-up to the mistake if it requires a remedy months later- not blame the party they were billing.